Helping families design

a life of financial freedom

Beyond the 9–5

Build Wealth. Fund Dreams.

Live a life you don't need a vacation from.

We Understand the Pressure — and the Possibility

You’re working harder than ever — but it feels like you're falling behind.

You’ve got the job. The income. Maybe two.

But between childcare costs, saving for college, dreaming of that big fat Indian wedding, and trying to enjoy life now — it feels like you’re running on a treadmill..

You scroll Instagram and see your friends buying homes, investing smart, retiring their parents, taking trips.

You’re earning more than ever… but still unsure where all your money is going.

You’re trying to protect your future — but wondering if you’re sacrificing too much of today. How much is enough? What if you’re missing something big?

There’s no tracker. No dashboard. No clear plan. And without that, it’s hard to feel in control. You’re not behind — but you don’t feel ahead either.

Kenobi Wealth was built for Indian American families and professionals in their 30s and 40s — building careers, raising kids, and realizing they want to stop relying on a job and start designing a life they don’t need a vacation from.

01.

Milestones that matter — kids, homes, and travel

03.

Early freedom when you're an empty nester

You don’t need just investments.

You need structure, clarity, and momentum around:

02.

Future Ivy League tuition and big fat Indian weddings

04.

A home that can care for aging parents (when the time comes

Your Membership. Your Plan. Your Freedom.

Your Wealth Grows. Our Fees Don’t.

At Kenobi Wealth, we don’t just manage your money — we help you design a life that works for your family, your future, and your freedom.

Our membership model puts your goals — not your assets — at the center. You pay one flat monthly fee — based on your life stage, not how much money you have. Because advice shouldn’t cost more just because you’re doing better.

Most advisors charge 1% of your assets every year — even if they don’t give you a real plan. The more you grow, the more they take… even if they didn’t help you get there.

Do you have a written plan that actually gives you clarity?

Do you know what your advisor is being paid to do?

Is your wealth growing faster than their fees?

With Kenobi, there are no hidden fees, no pushing products, and no confusing percentages.

Just clear advice, flat fees, and full alignment — always.

And yes — investment management is included.

You can invest through us or manage it yourself — we’ll guide you either way.

What Will AUM Fees Really Cost You?

| Portfolio Value | 20-Year Comparison | 30-Year Comparison |

|---|---|---|

| $500K | Traditional Advisor: $315,013 | Traditional Advisor: $904,717 |

| Kenobi Wealth: $96,000 | Kenobi Wealth: $144,000 | |

| $1M | Traditional Advisor: $630,025 | Traditional Advisor: $1,809,434 |

| Kenobi Wealth: $96,000 | Kenobi Wealth: $144,000 | |

| $2M | Traditional Advisor: $1,260,050 | Traditional Advisor: $3,618,868 |

| Kenobi Wealth: $96,000 | Kenobi Wealth: $144,000 | |

| $5M | Traditional Advisor: $3,150,125 | Traditional Advisor: $9,047,171 |

| Kenobi Wealth: $96,000 | Kenobi Wealth: $144,000 |

Assumes 10% annual portfolio growth with 1% AUM fee. Kenobi Flat Fee based on Freedom Accelerator.

You get real planning, full investment strategy, and ongoing human support — without handing over a percentage of everything you’ve built.

The Kenobi Experience

Discover the Kenobi difference.

Your culture + Your goals + Our guidance = A life you don’t need a vacation from!

Your life may be complicated — your financial plan doesn’t have to be.

At Kenobi Wealth, we’re redefining what Indian American families should expect from a financial advisor.

What You Get With Your Kenobi Membership:

Financial Planning for Life’s Big Moments

From budgeting to milestone tracking, we help you organize your finances around what matters — kids, homes, and travel.

Education & Wedding Planning

529s, Roths, IULs — we help you fully fund college and prepare for weddings without derailing your long-term goals.

Investment Strategy & Portfolio Guidance

Whether you invest through us or elsewhere, we help you build a plan around your goals — with risk management, diversification, and long-term clarity.

Income Generation & Alternative Investments

From real estate to Amazon stores and private yield funds — we help you build income streams beyond your job.

Tax Planning & Filing

No more spreadsheets or surprises. We review your return, optimize your structure, and file it for you — done and done.

Insurance Review & Risk Planning

We audit your life, disability, and long-term care coverage — and help you understand what’s working (and what’s not).

Estate Planning & Protection

We help you create or update wills, trusts, and guardianship plans — with the cultural nuance your family actually needs.

Cash Flow Optimization

You make great money. We help you actually see it, structure it, and grow it with purpose.

Built for Life in Motion

Life doesn’t wait.

And neither should your plan.

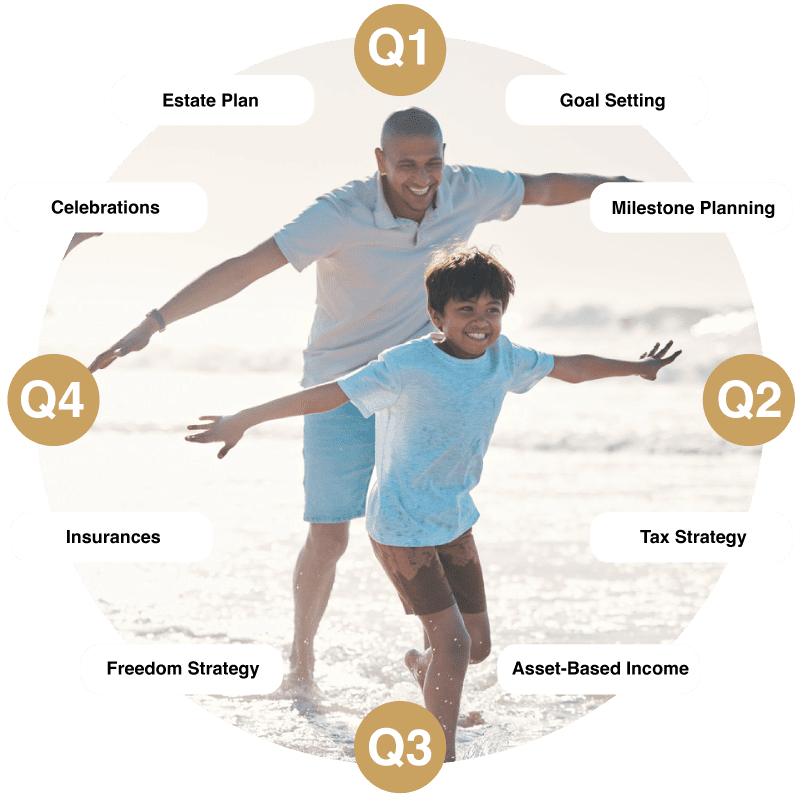

We meet quarterly to review, refine, and realign every part of your strategy. As life changes — new babies, home upgrades, career shifts, or in-laws moving in — we evolve your plan together.

Built for Families Like Yours

Would you take financial advice from someone who hasn’t built freedom themselves?

At Kenobi Wealth, we believe your advisor should be walking the same road — not watching from the sidelines.

I’m Anand Narayan — a husband, father, and founder of Kenobi Wealth. I served as a Naval officer, built and sold companies, and went to an Ivy League school. But more importantly, I’ve built this firm for families like mine — planning for college, future weddings, aging parents, and retiring at 55 with freedom and intention.

You deserve radical transparency

How can you trust someone to guide your financial life if you don’t know how they’ve managed their own?

- Ask me about my net worth.

- Ask what’s in my portfolio.

- Ask how I’m funding my daughter’s college, her wedding, and our family’s early retirement.

I’ll show you — because that’s what alignment looks like.

Our membership is exclusive, I don’t work with everyone — and that’s intentional.

Once you’re accepted, you have full access to me personally.

We partner with families who are serious about building freedom early, with structure, clarity, and purpose.

Ready to see what this looks like?

Questions?

At Kenobi Wealth our journey began with a simple yet powerful mission: to empower individuals and businesses to achieve their financial goals through expert guidance and unwavering support.

Or reach out directly — we’re real humans, not bots.

Final Thought:

This isn’t financial planning the way your parents did it.

This is for families who want to live better, not just retire richer.